- Home

- Short Sale Information

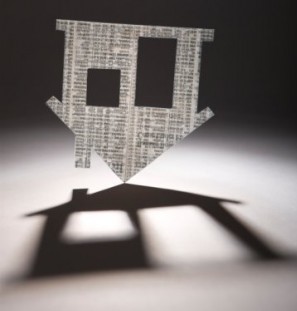

What is a Short Sale?A real estate short sale is a form of agreement between the seller of a home in the beginning stages of foreclosure and their lender, allowing the home to be sold for less than the existing loan balance outstanding. The mortgagee would accept less than the loan amount in order to avoid a foreclosure proceeding. This short sale would result in a substantially discounted purchase price for the buyer of the home. The buyer would then proceed with the purchase of the home much the same as in any conventional real estate transaction.

Why would a lender agree to a short sale? Lenders are in business to make money and keep down losses. When a borrower gets behind on their loan payments, the lender has the right to take the property to pay off the debt. However, in the current real estate market, many properties cannot be sold for the amount owed against them. It is possible to persuade lenders to take less than the full amount owed if the lender believes that it will make more money through a short sale than through a foreclosure.

This is totally up to the lender. Some lenders take as little as two weeks, some over six months. The only way to know is to start the process. The key is making sure that your short sale package is complete, and that you follow up daily with the lender. I want to do a short sale and I have a second mortgage, does this make me ineligible? No. Both of your lenders will need to be satisfied in some way to complete the short sale. If your first lender will be paid off by the sale, then you just negotiate the terms with the second lender. Will a short sale destroy my credit? Yes and no. The short sale may not show up on your credit. In fact, most mortgage trade lines report “Mortgage Paid” after a short sale. Any late payment history will still appear, as will any Notice of Default filings. What won’t report is an actual foreclosure. A promissory note may prevent the lender from reporting the mortgage as a loss. In today’s credit market, a foreclosure may prevent you from obtaining a mortgage for at least 5 years, longer than a bankruptcy. What documents are necessary to proceed with a short sale? The individual documents necessary to proceed with the short sale will depend on the lender. Typically the lender will require a hardship letter detailing the circumstances behind the short sale. A signed, valid purchase and sales contract, preliminary HUD-1 settlement statement and a preliminary estimate of proceeds to the lender. There may be additional requests for more detailed information on the financial condition of the setter, i.e.; pay check stubs, bank statements, a personal financial statement and monthly budget assessment, amongst other things. What is a Hardship? Some examples of a hardship include:

What is the effect of short sale on the seller? The seller’s debt is cleared. Some lenders may mark the transaction as a settlement, which will hurt the seller’s credit score. How late in the pre-foreclosure process can you start a short sale? Depending on individual state law and regulations, a foreclosure can proceed as quickly as 35 days from the date the notice to the borrower is filed. For that reason, time is of the essence and you should allow a window of no more than 60 days to effectuate a lender approved short sale. If a seller is in bankruptcy, will that affect the short sale of the property? Absolutely, as most lenders would not consider a short sale if the homeowner is in the middle of a bankruptcy proceeding. Negotiating a short sale between the parties is considered a collection activity and such a negotiation is prohibited in bankruptcy. Check with your agent to determine how your specific situation may be affected. Are there tax implications in short sales? I can refer you to a tax attorney for correct tax information that pertains to your specific circumstances. Can investment properties be short sold? Most definitely. Any type of property can be sold through a short sale.

|

Quick Search

Based on information from California Regional Multiple Listing Service, Inc. as of Mar 01, 2026. This information is for your personal, non-commercial use and may not be used for any purpose other than to identify prospective properties you may be interested in purchasing. Buyers are responsible for verifying the accuracy of all information and should investigate the data themselves or retain appropriate professionals. Information from sources other than the Listing Agent may have been included in the MLS data. Unless otherwise specified in writing, Broker/Agent has not and will not verify any information obtained from other sources. The Broker/Agent providing the information contained herein may or may not have been the Listing and/or Selling Agent.

Display of MLS data is usually deemed reliable but is NOT guaranteed accurate.

Datafeed Last updated on March 1, 2026 @ 12:00 am